Trusted by

What do you do?

Family Office

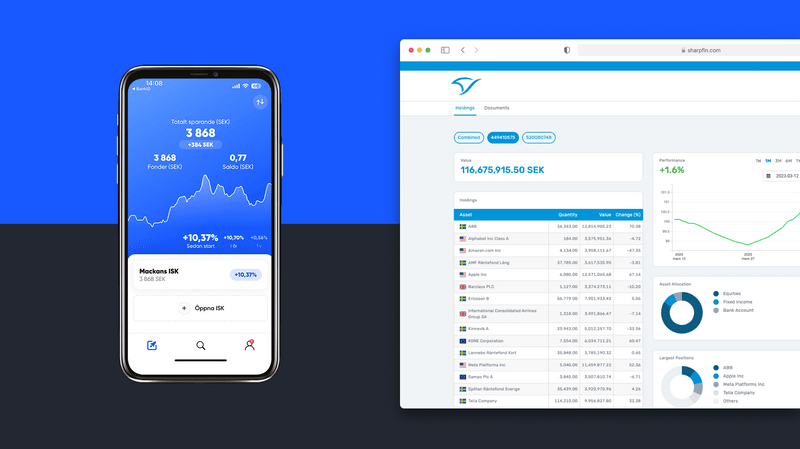

Free up your time utilizing Sharpfins consolidation of wealth management data throughout multiple sources.

Wealth Manager

Wealth management is possible with only one tool for customer onboarding, constant monitoring of KYC and AML, flexible portfolio management and branded customer reporting. Sharpfin is the proof.

Financial- and Pension advisor

Sharpfins advisory portal helps you to significantly cut time in your advisory processes, all while making the results electronically traceable and with a seamless integration of electronic signatures.

What you might say when using Sharpfin

Patrik Soko

CEO Consensus Asset Management

With Sharpfin we have found a vendor with a brilliant understanding for our needs. Their solution significantly increases quality in our customer reporting and saves a lot of time for our wealth management and administration personnel.

Wolfgang Lechner

Regional Manager, Privat Consult

I love the user friendliness of Sharpfin Wealth Management Suite. With their flexible compliance rules engine we now have a better view over the risks in our investments, and with a full history of changes.

What we can do for you

Wealth consolidation

Sharpfin enables consolidation of both allocation and performance for your clients with holdings scattered across banks, with multiple depots in one bank or with your unlisted securities.

Remote client onboarding

Digitize all your customer documentation in a simple and structured way. Utilize our seamless integration with Scrive to sign remotely.

Monitor your risks

We make sure that your clients holdings are in line with the agreed risk level at all times. Sharpfin offers constant real-time monitoring of your clients allocation and risks.

Save administration time

Calculating your management fees can be a time consuming task especially if you offer performance fees or management fees based on daily asset under management. Using Sharpfin, this task is done within less than 5 seconds.

Strengthen your brand

By using our reporting or customer portal function you can move closer to your clients with branded, secure login to the system or tailor made client reporting.

Limit compliancy risk

Together with our partners we offer to monitor all your clients for PEP and money laundring on daily basis. You can easily manage this process through the Sharpfin user interface.

See Sharpfin in action

Sharpfin Insider

11 October, 2023

Swedish fintech companies Datia and Sharpfin collaborate to launch pioneering sustainable investing solutions for Wealth Advisors

Two prominent Swedish fintech companies, Datia and Sharpfin, are joining forces to equip Wealth Advisors for sustainable investing.

24 May, 2023

Strand Kapitalförvaltning selects Sharpfin for a full coverage wealth management solution

20 April, 2023

Fredrik Simonsson, Co-Founder of Expisoft: “Financial companies that have a handle on their cybersecurity will have a competitive advantage going forward”

12 April, 2023

Sharpfin & Fondo expand their market reach with a fully digital solution for wealth managers

24 February, 2023

Frida Emanuelsson, COO at Strand Kapitalförvaltning: “Digitalization will play a big part in reaching those not interested in finance today”

Never miss a thing

Subscribe to our newsletter. In Sharpfin Insider we share important updates, interesting articles, release notes and trade secrets. You don't wanna miss it.

Do you want to know more? Send us a message below.

Contact us

Address

Vasagatan 10, 4tr

111 20 Stockholm